Introduction

Assalamu Alaikum dear member kya haal chaal hai Dor market Mein kam karne ke liye aapke pass Achcha knowledge aur experience Hona bahut jaruri hai Jitna Achcha aapke pass knowledge Hoga Iske साथ-साथ main aapko yah bhi batata Chale ki main aap Logon ke liye naya topic Lekar topic se Kafi jyada fayda hai

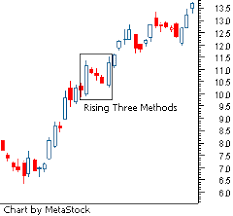

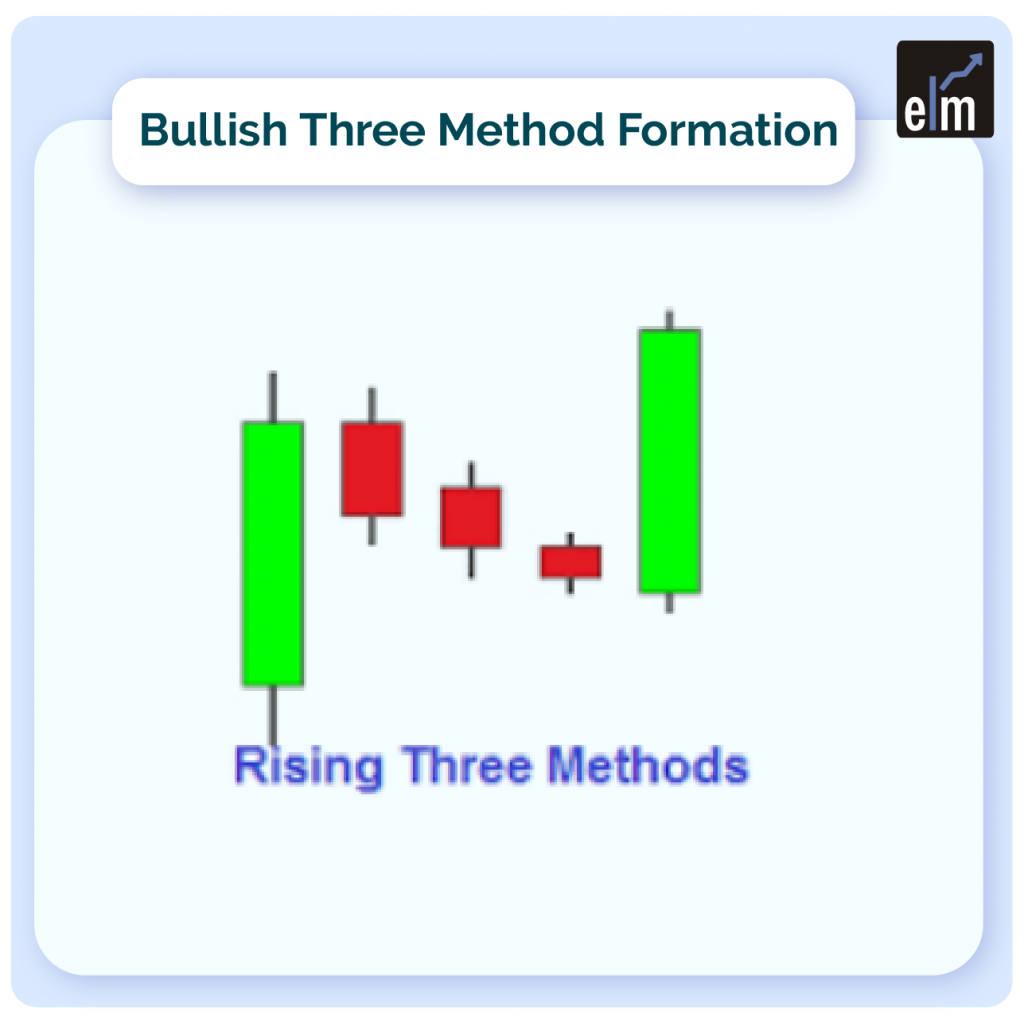

Rising Three Method Pattern:

Dear member rising 3 candistic pattern price chart calculation high price Mein use time Banta Hai Jab market per bearish Ek nakam koshish karte hue price ko bear is trend reversal karne ki koshish Karte Hain Jiske result Mein price Bullet market ka control Dobara Hasil karte hain aur bhi Rishte Jo Thode bahut Inka na the friend reversal ke vah sare khatm Ho Jaate Hain is type ka pattern Aksar Ek Jaal ka kam karta hai aur jo bhi Rish market Mein inter Hona Chahte Hain inhen is Baat Ko yakin hi banana chahie ki ek long bearish candle Jiski closing price fast bullet candle ke height ya open price se kam ho Jani tab hi market Mein bear stand reversal Hoga Nahin to Samal bearish candles ke sath last bullish candles ki vajah se kam ho Jaate Hain.

Candle Formation:

Dear rising 3 candles pattern 5 ya usse Jyada candles Par mustamel Ek Bullishe Mein first aur last candle Ek long real body wali bullish candal Hoti Hai Jab Kidhar Mian Mein banne wali candle takriban Tamam Small real body Mein Hoti Hai Jiski tafseel darja zail hai.

First Candle:

dear rising 3 candlestick pattern ki first candle Lake bullish candle hoti hai aur Iske main reason Ye Hote Hain ke Kyunki pattern Ek bullish trend Mein banta hai yah candle Ek long real body Mein Hoti Hai jisse price ki majbuti Ka andaza Hota Hai.

Second Candle:

rising 3 candlestick pattern ki second candle Ek Saman real body wali candal hoti hai jo first candles ke beeresh open hokar Lo price per close Hoti Hai yah candle selling pressure ki vajah se banti hai but Jyada strong reaction Nahi Deti Hai Kyunki candle ki real body bahut small hoti hai.

Third Candle:

rising 3 candlestick pattern ki third candle be same second candle Ki Tarah Ek Saman real body Mein banti hai yah candle dusri candle ke bottom per banti hai but first candle bearish ke close price Allo per close Hoti Hai jisse andaza hota hai ki yah candle Bhi Jyada strong reaction Nahi Deti Hai.

Forth Candle:

rising pre candlestick pattern ki 4th candle be same small scandal Ki Tarah Sambhal real body Mein Ek Baarish candle Hoti Hai Jiska close price open price se lower per hota hai yah candle behaler ki market Mein maujudgi ka Ehsas dilati Hai what Jyada strong real body na hone ki vajah se price per Jyada Asar Andaaz nahi hoti hai yah candle bhi first Bullish candle ki real body Mein banti hai.

Fifth Candle:

rising three candlestick pattern ki last candle Ek bullish candle hoti hai jo first Baarish candle ke bad open hokar Ek Badi Bullishe real body banne ke bad higher side per close Hoti Hai yah candle market Mein Ek mamuli vaksa ke bad buyers ki wapasi ko jahir Karti Hai jisse vah price ko Teji ke sath Upar ki taraf push Karte Hain.

Explaination Of Rising Three Pattern:

Rising 3 pattern banne se pahle market Mein bullish trend Ka Hona important hai is vajah se pattern Mein first candle Ek lambi bullish candle hoti hai jo is baat ki Nishan Dahi karti hai ki pattern ke aagaaj mein bullish market per Havi Hai bullish Trend ke dauran Kuchh invester koshish Karte Hain Ki Hamen Bulleh market se excute karna chahie is vajah se pattern ki Agali candle Ek Saman real body wali bearish candal Hoti Hai pattern ki second Bullet candle Ko Dekhkar Majid sailors market Mein entry kar Jaate Hain jisse Agali do candles bhi Sambhal real body wali bearish Candle banti hai but yah candle first candles ke open price se down Nahin Jaati Hai yani pattern ki teenon sambhal ke inside mein open hokar close Ho Jaati Hai pattern ki last candle ek strong bullish candle banti hai jo teenon Samal bear standard ke top per close Hoti Hai jisse market ke bear stand reversal ke Inka Nath ko khatm karke price ko sem bullish trend Mein continue kar diya jata hai.

Trading With Rising Three Pattern:

Dear Rising 3 candlestick pattern price chart per bahut kam bante Hain but Iske asrath bahut strong hote hain jisse market Mein bike entry ki Ja sakti hai yah pattern market ke bullish trend Mein Ek mamuli Sevak ka banane ke bad price ko sem bullish trend Mein tasalsul Jari Rakhta Hai pattern per trading karne se pahle Ek confirmation candle Ka Hona important hai jo ki real body Mein Ek police candle honi chahie aur last candle ke top per close bhi honi chahie pattern use time invalid Hoga Jab Bhi iska bad Ek bearing candle Banegi yah bullish candle last candles ke bottom per close Hogi indicator Jaise RSI CCI MacD aur oscillator sy confirmission lene ke liye Inki trading value Hona chahie Jab Ke pattern ka stop last sabse bottom price ya pahle candle ke open position se 2 pipes below set Karen.

Assalamu Alaikum dear member kya haal chaal hai Dor market Mein kam karne ke liye aapke pass Achcha knowledge aur experience Hona bahut jaruri hai Jitna Achcha aapke pass knowledge Hoga Iske साथ-साथ main aapko yah bhi batata Chale ki main aap Logon ke liye naya topic Lekar topic se Kafi jyada fayda hai

Rising Three Method Pattern:

Dear member rising 3 candistic pattern price chart calculation high price Mein use time Banta Hai Jab market per bearish Ek nakam koshish karte hue price ko bear is trend reversal karne ki koshish Karte Hain Jiske result Mein price Bullet market ka control Dobara Hasil karte hain aur bhi Rishte Jo Thode bahut Inka na the friend reversal ke vah sare khatm Ho Jaate Hain is type ka pattern Aksar Ek Jaal ka kam karta hai aur jo bhi Rish market Mein inter Hona Chahte Hain inhen is Baat Ko yakin hi banana chahie ki ek long bearish candle Jiski closing price fast bullet candle ke height ya open price se kam ho Jani tab hi market Mein bear stand reversal Hoga Nahin to Samal bearish candles ke sath last bullish candles ki vajah se kam ho Jaate Hain.

Candle Formation:

Dear rising 3 candles pattern 5 ya usse Jyada candles Par mustamel Ek Bullishe Mein first aur last candle Ek long real body wali bullish candal Hoti Hai Jab Kidhar Mian Mein banne wali candle takriban Tamam Small real body Mein Hoti Hai Jiski tafseel darja zail hai.

First Candle:

dear rising 3 candlestick pattern ki first candle Lake bullish candle hoti hai aur Iske main reason Ye Hote Hain ke Kyunki pattern Ek bullish trend Mein banta hai yah candle Ek long real body Mein Hoti Hai jisse price ki majbuti Ka andaza Hota Hai.

Second Candle:

rising 3 candlestick pattern ki second candle Ek Saman real body wali candal hoti hai jo first candles ke beeresh open hokar Lo price per close Hoti Hai yah candle selling pressure ki vajah se banti hai but Jyada strong reaction Nahi Deti Hai Kyunki candle ki real body bahut small hoti hai.

Third Candle:

rising 3 candlestick pattern ki third candle be same second candle Ki Tarah Ek Saman real body Mein banti hai yah candle dusri candle ke bottom per banti hai but first candle bearish ke close price Allo per close Hoti Hai jisse andaza hota hai ki yah candle Bhi Jyada strong reaction Nahi Deti Hai.

Forth Candle:

rising pre candlestick pattern ki 4th candle be same small scandal Ki Tarah Sambhal real body Mein Ek Baarish candle Hoti Hai Jiska close price open price se lower per hota hai yah candle behaler ki market Mein maujudgi ka Ehsas dilati Hai what Jyada strong real body na hone ki vajah se price per Jyada Asar Andaaz nahi hoti hai yah candle bhi first Bullish candle ki real body Mein banti hai.

Fifth Candle:

rising three candlestick pattern ki last candle Ek bullish candle hoti hai jo first Baarish candle ke bad open hokar Ek Badi Bullishe real body banne ke bad higher side per close Hoti Hai yah candle market Mein Ek mamuli vaksa ke bad buyers ki wapasi ko jahir Karti Hai jisse vah price ko Teji ke sath Upar ki taraf push Karte Hain.

Explaination Of Rising Three Pattern:

Rising 3 pattern banne se pahle market Mein bullish trend Ka Hona important hai is vajah se pattern Mein first candle Ek lambi bullish candle hoti hai jo is baat ki Nishan Dahi karti hai ki pattern ke aagaaj mein bullish market per Havi Hai bullish Trend ke dauran Kuchh invester koshish Karte Hain Ki Hamen Bulleh market se excute karna chahie is vajah se pattern ki Agali candle Ek Saman real body wali bearish candal Hoti Hai pattern ki second Bullet candle Ko Dekhkar Majid sailors market Mein entry kar Jaate Hain jisse Agali do candles bhi Sambhal real body wali bearish Candle banti hai but yah candle first candles ke open price se down Nahin Jaati Hai yani pattern ki teenon sambhal ke inside mein open hokar close Ho Jaati Hai pattern ki last candle ek strong bullish candle banti hai jo teenon Samal bear standard ke top per close Hoti Hai jisse market ke bear stand reversal ke Inka Nath ko khatm karke price ko sem bullish trend Mein continue kar diya jata hai.

Trading With Rising Three Pattern:

Dear Rising 3 candlestick pattern price chart per bahut kam bante Hain but Iske asrath bahut strong hote hain jisse market Mein bike entry ki Ja sakti hai yah pattern market ke bullish trend Mein Ek mamuli Sevak ka banane ke bad price ko sem bullish trend Mein tasalsul Jari Rakhta Hai pattern per trading karne se pahle Ek confirmation candle Ka Hona important hai jo ki real body Mein Ek police candle honi chahie aur last candle ke top per close bhi honi chahie pattern use time invalid Hoga Jab Bhi iska bad Ek bearing candle Banegi yah bullish candle last candles ke bottom per close Hogi indicator Jaise RSI CCI MacD aur oscillator sy confirmission lene ke liye Inki trading value Hona chahie Jab Ke pattern ka stop last sabse bottom price ya pahle candle ke open position se 2 pipes below set Karen.

:max_bytes(150000):strip_icc():format(webp)/RisingThreeMethods4-d80e851a63d84c41a0808ab8c1fdc903.png)

تبصرہ

Расширенный режим Обычный режим